RMIS Systems and Claims Management Software

Specializing In

Small and Medium

Sized Companies

Recordables is a trusted claims management software company providing risk management claims systems for three decades to insurance companies, risk pools, and a wide range of companies and organizations. Our suite of services includes workers’ compensation software, FMLA tracking software, liability claims management solutions, and certificate of insurance tracking software. Companies across the U.S. trust Recordables for their RMIS system needs.

Software Solutions for All RMIS System and Claims Management Needs

Recordables specializes in RMIS systems and claims software for small—to medium-sized businesses and employers, focusing on client retention. All software is built with a focus on ease of use, scalability, and network security. Recordables RMIS software features a flexible design that allows it to be configured to meet the needs of each organization.

TrackComp®

TrackComp®

Trackleave®

Trackleave®

TrackAbility®

TrackAbility®

CertAdvisor®

- Claims Management

- Risk Management

- Compliance Tracking and Reporting

- Incident Reporting

- Workers’ Compensation Claims

- Safety & Occupational Health

- Case Management

- Family Medical Leave Act

- Short Term Disability

- Long Term Disability

- Reporting Analytics, trends, modeling and more

- Incoming Certificate Management

Why Organizations Choose RMIS Systems from Recordables

Easy-to-use Systems

Recordables risk management information system (RMIS System) is intuitive and allows organizations to improve efficiency right away with endless integration possibilities.

Cloud-Based and Secure

Keeping claims management data secure is a top priority, and Recordables RMIS system uses secure servers and data transmission protocols to make certain data is only available to authorized users.

U.S. Based

Support

Recordables customers can reach our U.S. based support professionals who are experts in claims management software, reporting workflows, as well as our RMIS System software tools.

Affordable - No Hidden Fees

Affordable, budget-friendly RMIS System. Pay only for what you need; multi-year pricing available. Maintenance and upgrades included within the cost — no surprise fees or additional charges.

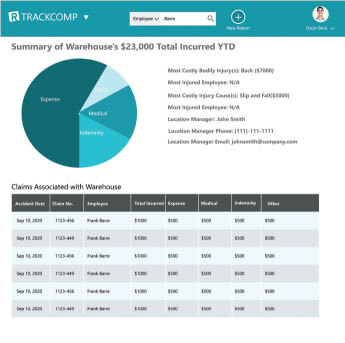

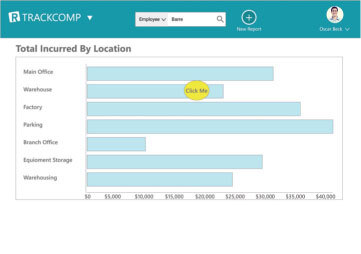

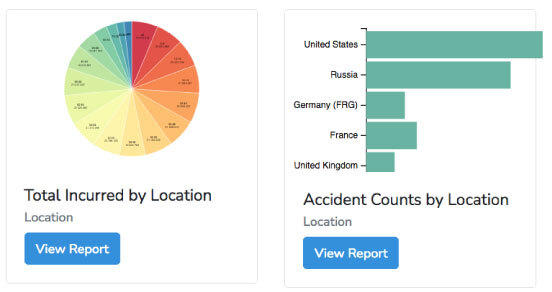

RMIS System Dashboards

Recordables RMIS System provides risk management dashboards. These include actionable information about liability and workers’ compensation claims. The risk management dashboards offer drill-down capabilities, allowing access to multiple levels of data, from a high level overview of all claims, to detailed information about specific claims. Risk management dashboards are available as part of Recordables risk management claims software.

What Users of Recordables Software are Saying

Recordables News

Providing you with the information you need to stay up-to-date on workplace risks and solutions.

Why a Privately Held RMIS Provider Can Be a Smarter Choice Than Big Box Vendors

Many organizations assume that the largest Risk Management Information System vendors offer the best solutions. However, larger brands may not always deliver superior service, flexibility, or value. Privately held RMIS providers often offer stronger accountability, more responsive support, and better long-term partnerships for small to mid-sized organizations. For over thirty

Introducing TrackVerify® by Recordables

Your New Ally for Smarter Facility Inspections and Compliance Management For over 30 years, Recordables has been the trusted name behind affordable, secure compliance tracking tools, such as TrackComp®, helping small and mid-sized organizations stay on top of workplace safety, workers’ compensation, and claims management. Now, we’re proud to introduce

Why Network Security Is Non-Negotiable in Workers’ Comp Tracking

And How Recordables Delivers Security, Affordability & Trust for Small to Mid-Sized Businesses When it comes to workers’ comp tracking, too many companies prioritize ease of use or integration options while overlooking a critical issue: network security. A single data breach can cost millions and erode the trust of employees,